News

The Ultimate Guide to Wildfire Insurance: Costs, Coverage, and Providers

Outline:

- Introduction

- The alarming rise in wildfire incidents.

- Why understanding wildfire insurance is crucial.

- What Is Wildfire Insurance?

- Definition and scope of coverage.

- How it complements standard homeowners’ insurance.

- Types of Wildfire Insurance Policies

- Standalone wildfire policies.

- Endorsements added to existing homeowners’ insurance.

- Bundled packages with other coverages.

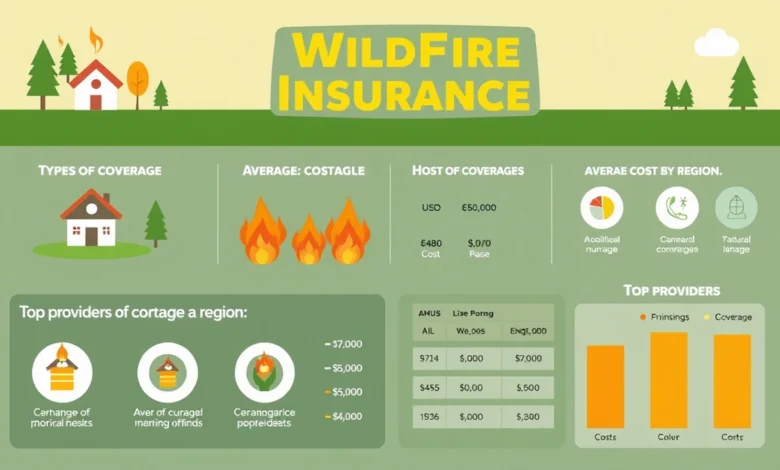

- Cost of Wildfire Insurance

- Average premiums by state.

- Factors affecting cost (e.g., location, home value, construction materials).

- Discounts and savings opportunities.

- Best Wildfire Insurance Companies

- Highlight 5-7 top providers based on affordability, coverage, and reputation.

- Include brief comparisons between them.

- How to File a Wildfire Insurance Claim

- Steps to follow after a wildfire incident.

- Documentation required for successful claims.

- Common pitfalls to avoid.

- Tips for Maximizing Your Wildfire Insurance Benefits

- Regularly review and update your policy.

- Invest in fire-resistant upgrades for your home.

- Keep detailed records of your possessions.

- Conclusion

- Recap of important considerations when purchasing wildfire insurance.

- Encouragement to act now rather than waiting until disaster strikes.

- FAQ Section

- Does renters’ insurance cover wildfire damage?

- Will my credit score affect my wildfire insurance premium?

- Are there government programs offering wildfire assistance?